The conversation began on Nov. 9 after President Trump announced on Truth Social that Americans — aside from higher earners — would receive a $2,000 “dividend” drawn from tariff proceeds. The President argued that the nation’s economic strength, booming markets, and rising tariff income make the plan achievable.

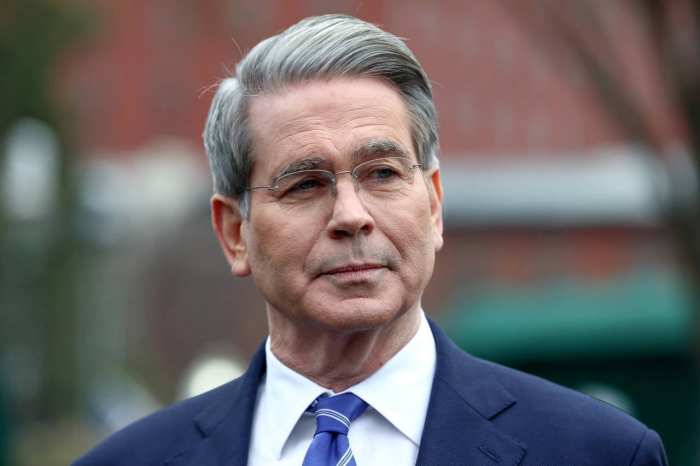

A week later, on Nov. 16, Bessent appeared on Fox News’ “Sunday Morning Futures” and confirmed that the administration wants the payments to reach “working families.” But he made it clear that Congress must approve the spending before any checks, rebates, or tax credits can move forward.

“These payments could go out,” Bessent explained, “but only with congressional authorization.”

He noted that lawmakers would have to determine both the structure of the payout and who qualifies.

This isn’t the first time Trump has floated a rebate connected to tariff revenue. Earlier this year, he signaled that while he was open to the idea, he was prioritizing paying down the national debt. He later said Americans might also receive savings tied to the Department of Government Efficiency (DOGE), which has claimed hundreds of billions in spending cuts.

However, new estimates from the nonpartisan Committee for a Responsible Federal Budget say the rebate—if structured like COVID-era stimulus—could cost as much as $600 billion, far more than the roughly $100 billion in tariff revenue collected this year through October.

Complicating matters further, the Supreme Court is reviewing whether Trump’s tariff structure is constitutional. Justices heard arguments on Nov. 5. If the Court strikes down the policy, the government could owe billions in refunds to businesses and individuals.

Trump, meanwhile, has been selling the proposal aggressively.

In his Nov. 9 post, he touted soaring 401(k)s, low inflation, record-high markets, and massive incoming revenue, promising that every non-high-income household would receive “at least $2,000.”

During Oval Office remarks on Nov. 10, he doubled down:

“We plan to deliver roughly $2,000 in dividends to middle- and lower-income families,” he said. And the remaining revenue will go toward reducing the national debt.”

White House Press Secretary Karoline Leavitt later reaffirmed the administration’s commitment to making the rebates happen, saying officials are pursuing “every legal option.”

Bessent has also indicated that the initial rollout may not involve physical checks.

Instead, he suggested the benefits could first appear as tax reductions—such as no tax on tips, overtime, or Social Security income, and deductions for auto loans—before transitioning to direct payments.

He also previewed upcoming policy changes, including larger tax refunds anticipated in early 2026 and a $1,000 “birth investment account” for children born in 2026, with applications opening in July.

Eligibility for the rebate is still unclear.

Trump has not defined what counts as “high income,” and no formal thresholds have been announced.

For perspective, analysts looking at a CARES-Act–style model assume the full benefit could go to individuals earning up to $75,000 and couples up to $150,000—standards used during the 2020 stimulus programs.

Congress, however, remains the deciding factor.

No legislation for Trump’s $2,000 tariff checks has been introduced, though Sen. Josh Hawley did propose a smaller rebate—$600 per adult and child—in July.

As for the much-discussed DOGE checks, the program is still far short of its $2 trillion savings target. As of Nov. 17, the DOGE “Wall of Receipts” cites approximately $214 billion saved—barely a fraction of the amount needed.

Bottom line:

Americans will not receive a tariff rebate until Congress acts, the Supreme Court rules, and the financing structure is resolved. For now, the administration insists the plan is alive—but there is no timeline for when money might actually reach taxpayers.

Sources: Clarion Ledger