It must have sounded like a good idea at the time, however Anheuser-Busch’s (New York Stock Exchange: BUD) The decision to run a Bud Light beer promotion with the help of transgender “influencer” Dylan Mulvaney backfired spectacularly. Conservative America did not like this idea at all, and decided to boycott the drink, thus no longer making it the best-selling beer in the United States.

With sales plummeting in the wake of the controversy, BUD shares went into a tailspin, dropping 20% in May with the company also laying off more than 300 US employees as a result.

However, despite the decline in US sales, the kind of pandemonium that is confined to the domestic market, strong performance in other markets has managed to offset some of the US sluggishness. In aggregate, organic volume in the second quarter was down 1.4% year-over-year with North America down 14% versus strong growth in the Asia Pacific region.

Meanwhile, one beer lover apparently decided to use the well-known advice of his friend. Bill Gates And Warren Buffett They are close friends, and the Microsoft founder seems to have adopted Buffett’s famous quote “Be fearful when others are greedy, and greedy when others are fearful.”

During the second quarter, its Bill & Melinda Gates Foundation Trust took a new position in BUD, acquiring 1,703,000 shares. As of now, the market value of these shares is around $95 million.

Morgan Stanley analyst Sarah Simon also backs the beverage giant and notes that success elsewhere offers protection from a passive US stance.

“Following successful implementation through Covid, 2023 saw ABI suffer a significant loss of market share in the US, primarily driven by consumer boycotts of its Bud Light brand,” Simon said. “While this makes for very negative headlines, ABI’s exposure to emerging markets limits the impact of the loss in US equities. After one-off costs in 2023, we see profitability growth resuming in 2024, with strong cash flow growth driving leverage to target.” 2.0 times, which would allow for an increase in the rate of return as well as the resumption of share buybacks from 2026. The current valuation fails to reverse this upside, in our view.

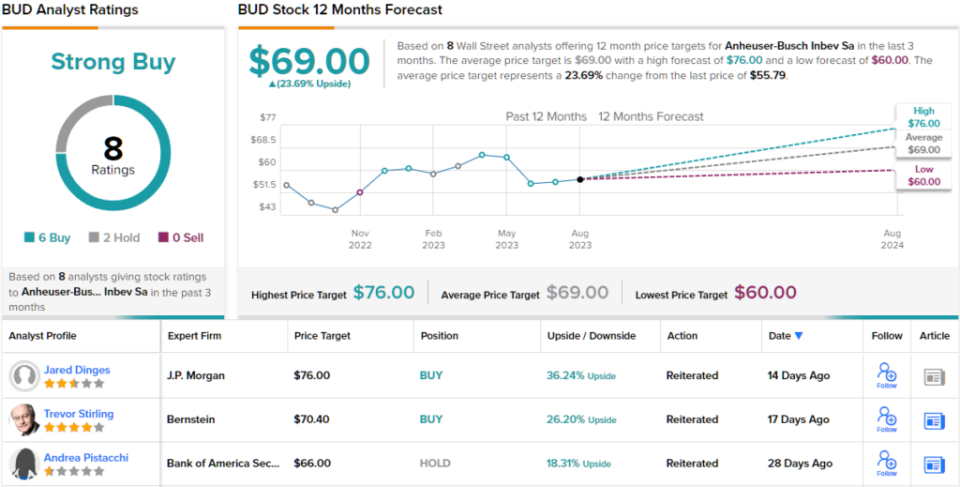

Accordingly, Simon has an overweight (i.e. Buy) rating on the stock in line with the $68.50 price target. Inclusion for investors? Potential upside of 23% from current levels. (To watch Simon’s track record, click here)

Most of the other analysts echo Simon’s sentiments. 6 Buys and 2 Holds adds to a Strong Buy consensus rating. Given the average price target of $69, the upside potential comes in at around 24%. (be seen BUD stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best stocks to buya newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.