-

Michael Berry’s bet against the S&P 500 could be painful, Kevin O’Leary warned.

-

It is because the index is diversified and short stocks are risky.

-

O’Leary says: Burry made about $100 million betting on the 2008 Crisis, but that was a different game.

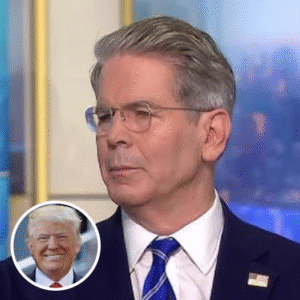

Michael Perry’s bet against the S&P 500 could pay off one day — but it could be painful for the “Big Short” investor in the meantime, according to “Shark Tank” star Kevin O’Leary.

O’Leary said of Burry in an interview Fox News Wednesday.

“To say I know when the market goes down — he will be right one day, when he is unknown. And how much pain he will have to take along the way, and does he have enough dry powder, as they like to say, in the margin office? Because in Every time this market goes up another 1-2%, this phone rings and they say “send more money”.

O’Leary’s remarks come a few days later Perry revealed that he had bought bearish options On two exchange-traded funds tracking the S&P 500 and Nasdaq-100 in the most recent quarter, they are betting a notional value of $1.6 billion against the two benchmarks. This is a brave move, O’Leary said, considering the broad range of stocks and sectors included in this bet.

O’Leary added that Berry made a personal profit of about $100 million after betting on the subprime mortgage crisis in 2008 — but his success was different at the time, only tracking one sector.

“What it’s doing now is very different. The S&P 500 has a whopping 500 companies in 11 sectors of the economy, and real estate is just one of them. You’d need to stumble sector by sector or at least the valuation of all the S&P’s would drop dramatically at the same time to win this.” the bet “.

The same is true of Burry’s bet on the Nasdaq 100, which is heavily focused in technology, but has leading stocks in various areas of the sector.

O’Leary said that means the head of Scion Asset Management has a high chance of losing a significant amount of cash, especially given that investors who short stocks have no limit on how much money they can lose.

“It’s a big risk,” he added.

It’s worth noting that Burry held put options against two index ETFs at the end of June, which limited his downside to the premiums he paid for the puts. There is no indication that he was shorting ETFs, which would expose him to the unlimited downside described by O’Leary.

Burry’s followers aren’t surprised at the risk he’s taking. Perry has warned for years The epic stock market crashAnd they previously told the investors that they were trading in one of the “The greatest speculative bubble of all time. At the heart of the market turmoil, he was S&P 500 could drop 57% to 1900 and Nasdaq could drop 56% to 6,000, Perry predicted last year.

Read the original article at Business interested